Please be aware that we are no longer accepting new clients until after 4/15/2025 in order to serve our existing clients during tax season.

You can use our client portal system to access your tax returns and other documents from our firm. In addition, you can upload your tax documents to your portal. Uploading your tax documents to your portal is convenient and more secure than using email or postal mail and we encourage you to do so.

How to upload documents to your client portal:

- Under the “documents” section of the portal, use the “Select file” button at the bottom of your screen to choose your files.

- You may upload zipped files, but please do not upload password-protected files as we cannot access them.

- Please upload supporting documentation in the same portal as the respective tax return.

- For example, when you log into your portal using the credentials for your personal (1040) tax return, upload the documentation for that specific return.

- When you log into the portal for your business return (1065, 1120, 1120S, etc.) upload the tax documentation for your business return.

We appreciate your help keeping materials organized by return type.

How using your client portal works:

- When we publish a document, you will receive an email saying your draft is ready to review.

- You can retrieve drafts and final copies of your documents by selecting from the main navigation menu: Client Tools and clicking on the Portal/Retrieve Document link (you can also click on the button at the top of this page).

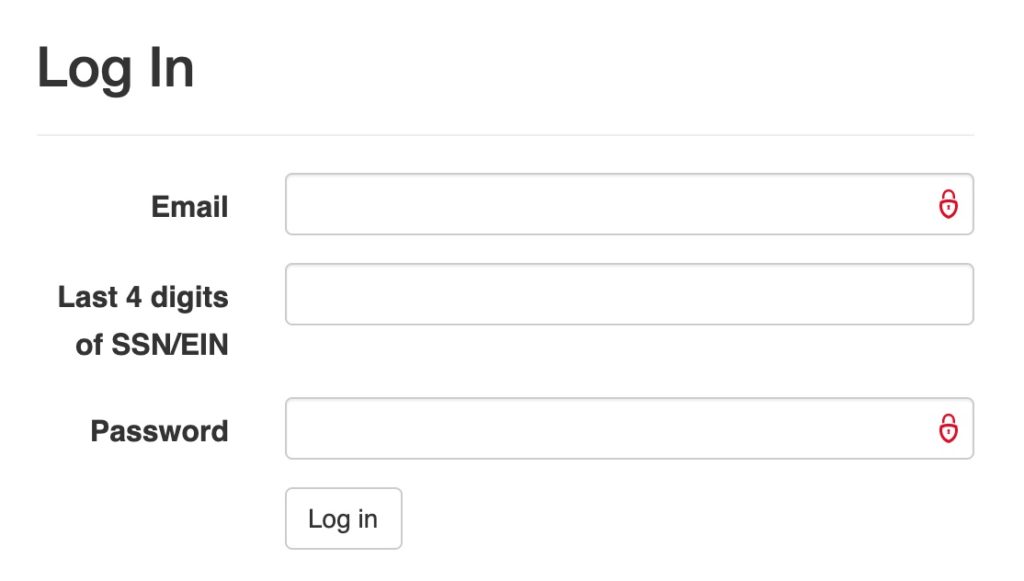

- You will see the portal login page: Please be advised that the portal is set up by your tax return type. This means that if we prepare multiple returns for you, each return requires a separate login. Please also note:

- Each login requires an email (this will be the one in our system that we use to communicate with you), a password and the last 4 digits of your SSN or EIN (applicable for entity filings- 1120,1120S, 1065, 990, 706 and 1041 filings).

- For your convenience, if you have forgotten your password you can retrieve it using the portal system.

- You can change your password after you log in.

If you need assistance, please contact us.